How to speak with your teenager about money

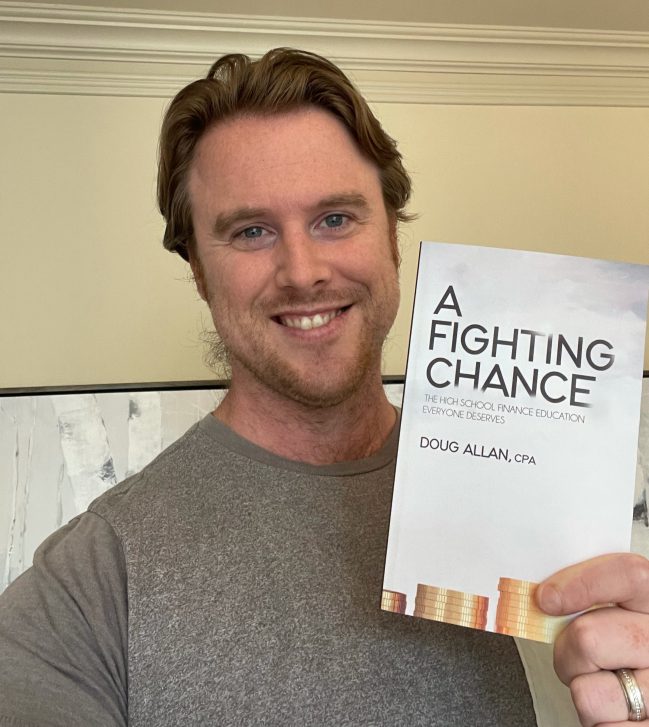

Advice from Doug Allan, Tellwell’s September author of the month and author of A Fighting Chance: The High School Finance Education Everyone Deserves

Vancouver-based author and accountant Doug Allan believes financial literacy is fundamental to success and should be part of our high school education system. To help parents fill that educational gap, he wrote A Fighting Chance: The High School Finance Education Everyone Deserves. Allan’s book was released in early 2021, selling hundreds of copies, and earning thousands in book royalties.

He has had some notable moments which includes appearing in The Globe and Mail, CTV News, The North Shore News and the MapleMoney podcast. He was also asked to speak at various high schools in his region on money topics he covers in his book.

The Tellwell author highlights a special moment chatting with David Chilton of The Wealthy Barber. Read more to learn the key steps Allan took to ensure his book’s success.

What inspired you to write Fighting Chance?

As a CPA, CA and a parent of two young children, financial education is near and dear to me. Over my career in finance, I have accumulated an immense amount of knowledge which I have, in turn, applied to my personal finances. Without the benefit of a financial education, most people do not have the opportunity to properly learn how to manage their money. The unfair advantage I have gained, as it relates to managing my personal finances, over those without formal financial education and experience inspired me to write down my knowledge as the book I wished I was given as a teenager.

What do you hope readers will get out of it?

I am hopeful that readers can learn one or two things within the pages of the book that gets them excited about their finances and the opportunities which are out there. I don’t expect everyone to finish the book and instantly be a financial expert, but if certain foundational lessons like the time value of money can be absorbed, readers will be much better prepared to manage their money. After reading my book, it is my hope that readers will advance to more complex financial topics and continue to learn.

In your book, you state that governments and school boards are failing our children by setting them up for financial failure once they enter the workforce. What steps would you like to see schools take to better educate youth about making and managing money?

In my opinion, personal finance should be more than a secondary topic in school curriculums. To me, understanding how money works is as important as learning about math and science. I would hope that one day, the school system recognizes the need for more curriculum content that focuses on life skills, like finance, that students need to succeed in life. Personal finance is a topic that broadly impacts everyone regardless of the career choices they make after school and therefore in my opinion it deserves a larger allocation of student learning time.

Why is it important for high school youth to become financially educated before graduation?

Success in personal finance largely hinges on using one’s most valuable asset, time. The concept of compound returns means that wealth growth depends on investment returns earning investment returns, just like a rolling snowball. The more time people have to grow their wealth, the higher the chance they have at accumulating enough to become financially free. Waiting until 35 or 40 years of age to begin properly managing finances results in a substantially more difficult effort to achieve financial goals. To illustrate, consider the following. $1,000 invested for 40 years at an annual return of 10% will become $45,000. That same single $1,000 investment for 20 years only grows to $6,700. Time is on the side of the young; the earlier they embrace financial knowledge, the better.

What advice do you have for parents who would like to teach their kids about money management?

Other than buying them a copy of A Fighting Chance: The High School Finance Education Everyone Deserves? All jokes aside, it is challenging for many parents to teach their children about finance given they themselves never had the benefit of a proper financial education. A significant advantage we have these days is the virtually limitless supply of knowledge for little or no cost online and at libraries. Encourage your children to subscribe to Youtube channels that focus on personal finance, find credible Instagram or TikTok educators to follow or simply pick up a few books from the library on finance. Let’s face it – talking about tax planning and debt management isn’t exactly riveting all the time, so finding a way to make finance entertaining, exciting and engaging is critical for absorption by youth.

How can parents develop a back-to-school curriculum on their own around these topics?

At the high school level, where virtually no knowledge yet exists for most kids, starting with the foundational concepts is most important. My book attempted to walk through these concepts at a digestible high level to peak interest, but not to overwhelm. Once captivated by the magic of compounding, level up to more complex foundational topics like risk management and opportunity cost. Only once these building blocks are in place does it make sense to get into the weeds of topics like individual asset class comparisons, good debt vs. bad debt and tax returns.

What would you say are the top three takeaways from your book?

Great question. I actually included three to five top takeaways in each chapter of the book, but if I had to pick the top three it would be:

- Start early – the sooner the better

- Take risks – nobody ever became wealthy with savings

- Don’t be afraid of debt used for the right purposes, but beware of its pitfalls

Your book came out in January, and you’ve sold hundreds of copies in just a few months. Congratulations! What were the key actions you took to make it a success?

In the early months of the book’s release, I worked hard on media and influencer outreach to get the word out. Whether it was contacting reporters, podcasters or personal finance gurus, I tried my best to get anyone who I thought might have aligned interests of spreading financial literacy to be an advocate. As a result, I was fortunate enough to have people with large existing followings like Patti Lovett-Reid (CTV/BNN), Rob Carrick (Globe & Mail), and MapleMoney podcast feature the book.

I also have been trying to build a brand around A Fighting Chance and launched a website where I write regular blogs on personal finance as well as social media accounts like Instagram and Twitter where I post regularly. In the past 8 months, the content created has resulted in just under 2,500 followers from all over the world. @afightingchancefinance is my handle on Instagram if anyone wants to follow! Please also visit www.afightingchancefinance.com.

Please share the successes you’ve had with your book. This can include media interviews, reviews, awards, events, etc.

I was very excited to be featured in my local newspaper in North Vancouver, The North Shore News. Several local teachers at high schools noticed the article and invited me to present to their high school classrooms, which I did. When I launched the book, I was humbled to be able to speak with David Chilton, the author of The Wealthy Barber, and pick his brain over the phone for 5 or 10 minutes. One of the most rewarding accomplishments has simply been to have my book acquired by my local library – now anyone who lives in my neighborhood can read it for free.

What marketing advice do you have for authors who are in the process of promoting their book?

Create a press release and book summary document for your book to give potential media an easy-to-digest way to understand what your book’s story is. Reach out to as many media outlets on as many different media channels as you can to make your case as to why their listeners, readers, viewers would find your book compelling to learn about. It takes work, but when you are passionate about your book and the mission you are on or the story you have to tell, it isn’t really work is it?

What is your plan to continue promoting the book this year and the next?

I am looking forward to being interviewed on an upcoming episode of “The Wealthy Life with Sybil Verch” which is a personal finance television show which airs on GlobalTV. Having a chance to discuss the book and its mission on a nationally aired TV show is an incredible opportunity. This November, I will be speaking on personal finance education at a Career Education Society conference in Vancouver for educators, in partnership with Junior Achievement BC, a leading provider of entrepreneurship and personal finance education to students. This will be an awesome chance for me to discuss the book and its contents with educators responsible for teaching our youth and hopefully convince them to weave in personal finance to their educational programs.

What’s next for you after this project feels complete?

I have a goal of writing more books in the A Fighting Chance series on other finance and business topics that I think deserve a spot in high school curriculums. The more that young adults know about how the world of business and money work, the better equipped they will be to navigate their careers and personal financial goals. No matter what each child decides to do in life, it is a guarantee that they will work within some kind of business organization, even if it is a not-for-profit or government business, and from that work earn paycheques. Understanding the mechanics of business and money will give them A Fighting Chance at achieving financial freedom.

Connect with Doug Allan

Website: https://afightingchancefinance.com

Instagram: @afightingchancefinance

LinkedIn: Doug Allan