Author of the Month: Karen Cumming Shares Financial Tips Throughout the Galaxy

Inspiring Real-World Change with Financial Literacy Tips for All Ages

Karen Cumming has worn many hats, from broadcast journalist and teacher to author and aspiring citizen astronaut. She even made it to the top 100 Mars One Mission candidates shortlisted to colonize the red planet! Her latest mission is to tackle financial illiteracy and help people build a brighter, more financially empowered future.

Paying yourself FIRST has the power to change your life. Believe it.

Karen Cumming, The Wealthy Martian

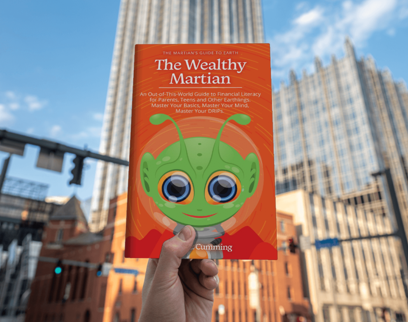

Karen’s journey through the limits of traditional education, as well as her own financial insights, have inspired her to help others break free from conventional money mindsets. In her new book, The Wealthy Martian, she brings her unique, out-of-this-world perspective to personal finance, making topics like investing, budgeting, and financial planning approachable and practical. By reframing money management through the lens of The Wealthy Martian, Karen invites readers to take charge of their financial lives with easy, effective strategies for achieving financial independence.

In her latest work, Karen shares stories, insights, and practical tips to help readers understand why financial literacy matters and how even small steps can lead to big rewards. Join Karen on this journey to a new kind of wealth, one that’s accessible and achievable for everyone.

What inspired you to use the concept of The Wealthy Martian to teach financial literacy?

I’ve been on a wild ride for more than a decade now as one of the Mars 100. I’m one of 100 people from around the world who made it to the final round of citizen astronaut selection in a legitimate mission to colonize Mars with the company Mars One. When you have a real opportunity to leave Earth forever, you begin to notice all the wonderful things you’re going to miss. We do so many things so well on this planet! But I also noticed some of the things we don’t do so well. At the time, I was working in the trenches as a teacher. I saw with my own eyes the fact that our school system does next to nothing to teach young people about money.

It stunned me. The more I researched, the more I began to understand that the education system was originally designed to train good employees, not to educate the middle class about money and help us to become financially independent. I knew that if I was going to write a book about financial literacy, it would have to be engaging, fun and incredibly user-friendly. Let’s be honest, if it weren’t, no one would read it. That’s when The Wealthy Martian was born.

The school system falls short in teaching financial skills and teaches kids to work for money instead of having their money work for them. Can you briefly explain this concept of having your money work for you?

It’s simple: the job of each dollar that we earn as a soldier in an army is to go out into the world and bring more dollars into our pockets. How does this happen? It happens when we invest those dollars, when we put them into blue chip stocks, for example, with a history of solid dividend returns over time. But how can we know how to do this if we were never taught about it in school?

The middle class has been conditioned to give their money to a bank and/or to put their money into mutual funds. The bank is in business to make money by paying us minimal interest on our deposits; it then lends that money at a much higher interest rate in the form of mortgages, lines of credit, credit cards and loans. The bank wins, we lose. Our mutual funds have management fees attached to them that can erode our retirement funds by as much as 2 percent or more.

Over time, it’s a massive amount of money that comes off the top of our returns.

Becoming financially literate is the best possible way for us to build a better life for ourselves and our families. Money doesn’t necessarily buy happiness. It buys the freedom we need to spend our time in whatever way is meaningful to us.

Could you share an example of how a small change in financial habits can lead to big rewards over time?

I write about The Wealthy Martian Seven: seven simple habits that can help you to create wealth over time. On the list: live beneath your means, pay yourself first, write down your goals, build a budget, get off the debt-go-round, buy insurance when you’re young, and write a will. Let’s take “living beneath your means” and “paying yourself first” as examples. If you do these two things alone, you are changing your financial future. The idea is to live on less than you earn, and then make yourself the priority each month, not the bills. When your paycheque comes in, immediately set aside money off the top to invest. Assuming that you are living beneath your means, there will always be enough left to pay the bills afterwards.

You have now empowered yourself to create those big rewards over time.

If you could give three quick financial tips to anyone starting out on their wealth-building journey, what would they be?

- Step outside of the matrix and think for yourself. You have been programmed. You need to replace that program with one that serves you in a much better way.

- Live beneath your means.

- Pay yourself first.

What future projects are you working on, and do you plan to continue exploring financial literacy in your writing?

I’ve developed a workbook called The Wealthy Martian Goals Journal. It’s designed to assist with goal setting in all areas of life, financial and otherwise. You’ll find it on my Instagram bio (@wealthymartian). I’m also developing an online course and a newsletter designed to teach the basics of financial literacy to Earthlings young and old.

The Wealthy Martian is part of a series called The Martian’s Guide to Earth. I’m currently working on a companion book called The Healthy Martian. It’s designed to help us take back control of our health and well being in a world that all too often tries to convince us that what we eat is actually good for us. I can’t wait to see it out there.