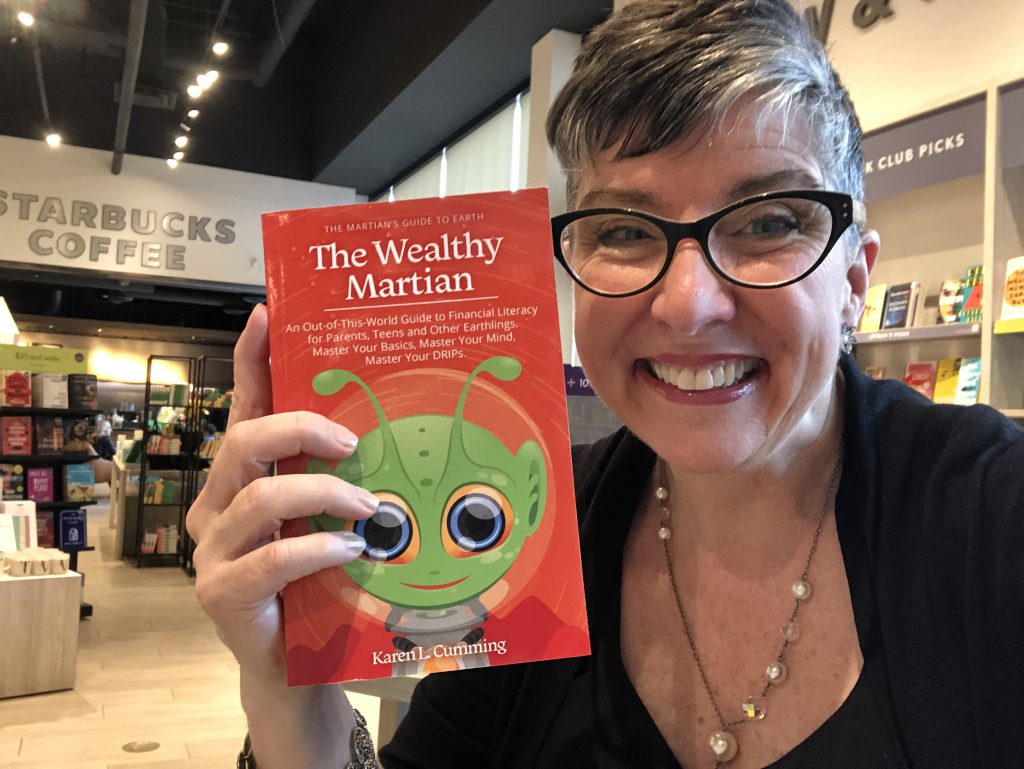

Author of the Month: Karen Cumming Shares Financial Tips Throughout the Galaxy

Inspiring Real-World Change with Financial Literacy Tips for All Ages

Karen Cumming has worn many hats, from broadcast journalist and teacher to author and aspiring citizen astronaut. She even made it to the top 100 Mars One Mission candidates shortlisted to colonize the red planet! Her latest mission is to tackle financial illiteracy and help people build a brighter, more financially empowered future.

Paying yourself FIRST has the power to change your life. Believe it.

Karen Cumming, The Wealthy Martian

Karen’s journey through the limits of traditional education, as well as her own financial insights, have inspired her to help others break free from conventional money mindsets. In her new book, The Wealthy Martian, she brings her unique, out-of-this-world perspective to personal finance, making topics like investing, budgeting, and financial planning approachable and practical. By reframing money management through the lens of The Wealthy Martian, Karen invites readers to take charge of their financial lives with easy, effective strategies for achieving financial independence.

In her latest work, Karen shares stories, insights, and practical tips to help readers understand why financial literacy matters and how even small steps can lead to big rewards. Join Karen on this journey to a new kind of wealth, one that’s accessible and achievable for everyone.